Have you been hearing about Worthy Bonds and wondered if the 5% interest rate is legit? I’ve been using it for over a year now, and here’s my Worthy Bonds review!

Keep your money somewhere it will grow. That’s one of my mantras on Young Retiree, because you can completely change your financial future by making your money work for you as early as possible. Every year that your money is accumulating compound interest can make thousands, or even millions of dollars difference decades down the road! Check out this recent video/post from CNBC (as of November, 2019) for the details on how that works.

There are many different ways to grow your money. Managed stock market investments and robo advisers (e.g. SoFI, Betterment, Wealthfront…), REITS and online real estate investing, rental properties, alternative investments ranging from litigation to exotic collector cars (seriously, check out the app Rally Rd, you can buy a piece of a collector car). Many of these investments are smart and lucrative, but they also come with a lot of risk.

Whatever you do, don’t let the potential of risk prevent you from investing your money. I use the SoFI robo adviser myself, and have made significant growth on my money by using it. Over a long-term period of time, with patience and consistency, a well-managed investment account like this will always leave you with substantial gains. SoFI has absolutely no fees, and no additional costs (if you’re skeptical or wondering how SoFi Invest makes their money, check out their explanation here), and it’s managed for you. Nothing could be easier. HOWEVER… stocks will always come with some risk.

That’s why it’s wise to keep large chunks of your money – the kind of amounts that you can’t afford to lose – in some safe, less aggressive holding. Luckily, that doesn’t mean you have to leave it rotting in a traditional checking account where it collects dust!

That’s where Worthy Bonds comes in.

How Is Worthy Bonds? My Worthy Bonds Review

My Rating After Using It: ★★★★★ 5 STARS!!

Growth Potential: 5% Guaranteed. No more, no less.

Risk Factor: Borderline Non-existent (read below)

Beginner Friendly: Extremely

Ok, I’ll be honest… I found Worthy Bonds through an Instagram ad.

If you’re anything like me, then you have a pretty hard time trusting advertisements. No matter how good something sounds, if I see it in a Facebook or Instagram ad I’m instantly more skeptical. They all try to sound so spectacular. They throw cartoon unicorns, and cartoon happy retired people, and lots of color in your face. They act innocent. They make big promises. But the bad news is, they also usually have fine print.

That’s why I’m your guinea pig (just a figure of speech. Animal testing is cruel and horrible). I took the bait. Worthy Bonds promises a 5% interest rate, no strings attached, no fees, and virtually 0 risk, and it sounded like the solution to my need for a low risk option.

We live in an age where we have the advantage of reviews on absolutely everything. So after consulting with a ton of other investors online, and even a friend or two who have been trying Worthy Bonds for a few months, I finally went for it.

So How Does Worthy Bonds Work?

Worthy Bonds (technically called Worthy Peer Capital), has been around since 2016, and it’s a fully owned off-shoot of the company Worthy Financial.

They can describe what they do best, but I’ll break it down for you here.

Worthy loans money out to small businesses. They do that with the money of investors (that’s you), which you can buy into in the form of bonds. Each bond is only $10! Then Worthy pays you back your money + a 5% interest rate in real time, as the lendee pays back their loan.

It’s not volatile, variable, or fluctuating, just a fixed return of 5%. I know that this rate is not as attractive as the wild returns you could get with stocks, real estate, or other investments, but it’s one of the BEST returns I’ve found for something that is this LOW RISK. While I definitely appreciate high yield savings account (I use the CIT Savings Builder account myself), even the highest yield savings accounts and CD’s barely keep up with cost of inflation. They are also vulnerable to the fluctuations of the federal interest rate. When I first got my CIT savings account it made 2.35%, and within 4 months it was only paying out 1.8% interest. My Worthy Bonds, in the mean time, have steadily made me 5% without a single blink.

The other feature I love so much about the way it credits my account, is that the interest accumulates daily. So instead of seeing my returns come in month-by-month, or waiting until the end of the year to see my gains, I can watch my money go up every single day. It’s a lot of fun, and it’s reassuring to watch it hustle for you.

So What Kind Of Risk Do You Have With Worthy Bonds?

The only way you will experience loss with bonds of this kind are when the lendee defaults on their loans. If the business that is borrowing from Worthy Bonds were to stop paying back their loan, you could stand to lose some of the money that you have invested in that business.

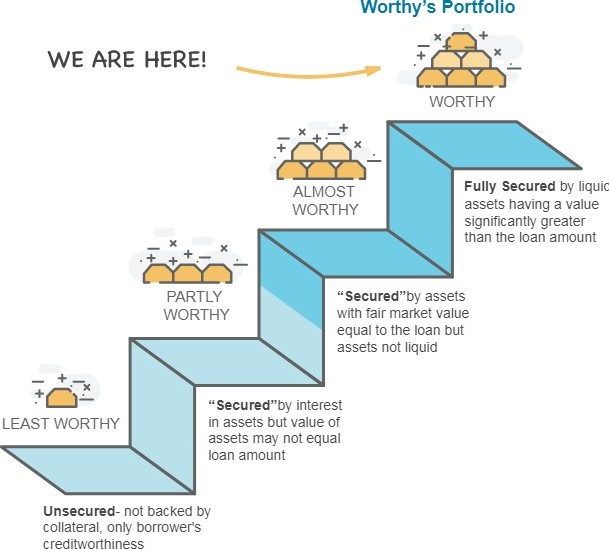

This may sound like more risk than you would like, but consider this. Worthy Bonds vets and screens every investment with EXTREME and strict care. They will not lend to businesses with bad credit. They won’t even lend to most businesses with good credit. They will not accept merely assets equal to the value of the loan, they require that the lendee possess the FULL AMOUNT OF THE LOAN in liquid cash before they will approve the loan at all. Here’s a graph from Worthy themselves breaking it down…

This standard makes Worthy Capital extremely low-risk to invest with. Your chances of loss are almost non-existent. On top of all this, Worthy further increases your safety by diversifying your entire portfolio. This means that as you buy $10 bonds, they will not all be invested in one small business. Your investment will be spread across a whole range of different businesses. This means that if one of the businesses defaults on the loan, you will not experience a total or even a significant loss on your full account, but just the amount that was invested with that single company.

This spreading of investments helps protect against losses.

To be clear, Worthy Bonds are NOT FDIC insured like your bank money is. Don’t put every penny of your life savings into Worthy, I’m not recommending that. I would, however, recommend that you use it as one of your primary savings accounts. I feel as comfortable with my money in Worthy Bonds as I do with my CIT bank account.

Is Worthy Bonds Easy For Beginners?

YES! Yes to the 10th power. Like the Robinhood app, or Acorns, Worthy Bonds has a strong focus on user friendliness. It’s extremely easy for someone who is unfamiliar with investing, and even unfamiliar with apps, to invest with Worthy Bonds.

If you’re pretty new to investing, this may be especially relieving. For a lot of people the most daunting obstacle to start investing is just figuring out how the whole thing works. When I started my first trades ever, on my TD Ameritrade account (which I’ve eventually come to love), it was like rocket science to me. It was like trying to read an alien language, scribbled on the wall of a cave. Being totally confused is lame at the best of times, but it’s even worse when you’re confused while managing your money.

So I was happy to find that Worthy Bonds is as simple and straight-forward as possible.

This may be frustrating to the more experienced investor. If you like to have a lot of control and involvement with all of your investing, the way you might with your stock market account, then Worthy Bonds may drive you crazy. Worthy does not even disclose what businesses they are investing your money with. You won’t know where your bonds are being held, and you can’t monitor the health of those companies yourself. When you login to the app, you just see your money, and how much it’s grown.

Worthy is best suited for the hands-off investor.

Give It A Try

So that’s my experience with Worthy Bonds so far. It’s one of my primary resources for saving, and it’s also the one that stresses me out the least. Yes, even my bank account is less comforting than my Worthy account… those interest rates are like Harry Potter wearing his invisibility cloak. You never know where it’s going to appear next (thanks to those fluctuating federal rates). Unlike Harry Potter, there’s no wizardry or mystery to Worthy Bonds. It’s actually one of the simplest investment opportunities.

If you think you’re worthy, then join Worthy using this link right here – JOIN WORTHY AND BE DOOMED FOREVER!! (Just kidding. You can take your money out of it any time you want, and run away if you want to).

If you join using that link, Worthy has a deal that you’ll get a free bond. It’s worth $10 (yeah I know, super life changing, right? Woo Hoo!). Keep in mind, you have to buy at least 20 bonds (an investment of $200), and keep it invested for 6 months to keep your reward. If you sign up at that link I’ll also get a free bond, so thanks! And if you decide to only invest $199 in Worthy Bonds out of spite… well… I’m glad you found a solid way to grow your money!

If you have any questions, please feel free to leave them in the comments below. I’ll do my best to give you an answer, and keep you updated on my own Worthy experience (here’s my April 2020 update, from the confines of the COVID-19 quarantine, sitting on my couch. Yup, still making 5%).

Edit: November 2020… still making 5%!